Posts filed under ‘Budgeting’

Writing Your Business Plan, Step 9: Financial Plan (Preparation)

Did you fire up your calculator? We are going to work through the financial plan. This is the final segment of your business plan. HURRAH! It requires some prep work and is a bit lengthy. So, we are going to break this down into 3 posts:

- Preparation (what to prepare before writing the financial plan)

- History (looking back on the finances of your business)

- Future (looking forward on the finances of your business)

First: Preparation

The financial portion of your business plan requires some planning and preparation. Let’s break it all down. (NOTE: This is just the summary in preparation for the actual writing of the financial plan which will take place next Monday and Tuesday.)

Soooo… here is what you are going to need to know. We’ll assemble this into financial statements next week:

- Assets – what do you own in your business? (computers, inventory, etc.)

- Liabilities (AKA Debts) – what do you owe in your business?

- Equity – how much have you invested (or has someone else invested) in your business?

- Revenues – how much did you make in sales in 2008? (this can typically come from your tax return)

- Expenses – how much did you spend in 2008? (also should be traceable to your tax return)

- Cash – where is that cash register? (not the physical register, but that paper thingie that tracks which checks you’ve written)

Spend the weekend putting these numbers together. Next week, we’ll be putting them into the “magical” financial statements of your business.

Come back tomorrow for a little business plan break. We’ll be featuring another fab industry insider.

Why Small Businesses Fail

Before we continue with steps 9-12 in the writing of our business plans (which involve financial statements) I thought it would be good to reflect on why it’s important to know your business’s financial details. Writing the financial portion of the business plan is usually the most challenging.

The wedding industry is made up of the most creative and artistic individuals. Individuals in the industry can be wildly successful without any business background. Unfortunately, many people are told “hire an accountant and let him or her do the dirty work.” While you MUST indeed hire an accountant, you MUST also understand the numbers of your business. And, I’m here to tell you: DO NOT BE SCARED.

I have an accounting degree and worked for an accounting firm right out of college. This makes me no different from you in running a successful business. None of what I learned is a mystery. None of what I learned is rocket science. I might have a little more practice, but that’s all. You practice at yoga, you practice at photography, you practice at design, you practice at baking. With practice, you can understand all of the numbers of your business. And, you can become even better. I’m not an expert. (Here’s a secret: no one is an expert.) But I practice a lot and I am constantly learning.

Fortune Small Business recently had a great article on “Why Businesses Fail“. I recommend you read the entire article here. (It’s simple, to the point, and so true.) In it Jay Goltz gives a real life example of a business that has had had strong revenues and loyal customer following, but has LOST MONEY for the last 8 years. Jay believes that 70% of small businesses go broke by their 10th anniversary because they don’t know their numbers. He highlights the following:

- Entrepreneurs tend to concentrate on what they love, whether it’s the artist who paints but doesn’t spend any time marketing or the chef who lives in the kitchen and ignores her financials.

- Every business owner needs to be his or her own CFO.

- Delegating that task to a bookkeeper or an outside accounting firm means putting your life into their hands.

- [The accountants] generally don’t know the ins and outs of your business well enough to make critical decisions.

So, before we embark on the financial elements on our business plan take the day to reflect on the things you want to practice. It is dangerous to strive for perfection. Strive instead for excellence. Excellence is achieved by practice. Practice is the journey, not the destination. Practice is something we DO.

I’ll see you back here tomorrow… ready to practice with your calculator! 😉

Easy-Peasy Budgeting

What does the pinup model have to with budgets? Well, while researching for this post, I came in contact with Mr. J Money who authors the blog Budgets are Sexy and I just couldn’t resist catching your attention with a sexy 1950’s pinup.

And, no this is not an April Fool’s Joke.

Advice from the blog Budgets are Sexy

J Money’s site targets personal finances, but there are some relevant points that apply to most small businesses. His advice is as follows:

- Track your spending for 3 months so you know EXACTLY what you spend and how you spend it.

- Create an emergency fund. This is as important in personal finance as with small businesses. As we’ve learned this year, you never know what is going to happen with the economy. Spending on weddings is down significantly since last year, and people who have cash cushions are in a stronger place. Sean Low of Preston Bailey Designs, Inc. recently talked on his blog about smoothing out cash flow to get away from some of the seasonal flux of our industry.

- Pay off all bad debt (eg. credit cards and lines of credit). Debt has a huge negative impact on the cash flow of your business. If you are paying off your credit cards (and the interest on them) you don’t have the cash to invest in your business. Get rid of this debt as fast as you can and you’ll have the flexibility to grow your business in much more lucrative ways.

Budgeting = Goal Setting

I like to think of budgeting for my business as goal setting for my business’s expenses. Ask yourself the following questions:

- What is it that I want to do with my money?

- What are my goals with my cash?

- What expenses do I have to pay each month?

- What expenses would I like to reduce?

- How much cash surplus (emergency fund) would I like to have?

By answering these questions, you’ll have a starting point for building your budget. From here you can start to build your budget.

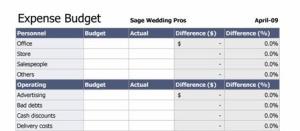

Tools to build your Budget

I like to use Excel spreadsheets or google spreadsheets to track everything. Excel has some great templates that are easy to fill in:

BudgetSketch (www.budgetsketch.com) is also an AWESOME online tool that’s FREE. It is also targeted at personal finances; however, it is easy to set up your accounts to reflect your business expenses. It also allows you to collaborate with business partners and share your budget communication.

Bill Barnett and Dewayne Greenwood are the masterminds behind the program. And, I like the mission behind this business. When I talked to Bill he said, “Dewayne and I wanted to create a simple, effective budgeting tool designed for one purpose only, to aid its users in creating a budget. [It was designed] certainly not to make Dewayne and me rich at the expense of others. We look at it as our way of paying forward the lessons we learned about getting, and hopefully staying out of debt.” What an awesome tool from these pay-it-forward guys! (Thanks Bill and Dewayne.)

Did I mention that Budgetsketch is FREE? (If it’s free, it’s me!)

What works for you?

The most important trick to budgeting is finding a system that works for you. It might be paper and pencil or Quickbooks Budgeting Software. But, find something that easy for you to work with… that you love… and that you think is SEXY!

The “B” Word: Budget

Being on a budget is like being on a diet. For me, it would be great to sit around eating cheese every day for every meal. But, the reality is that I need to have some restraint. It’s the same story with your business expenses. No one wants to be on a budget, but a healthy business requires it.

This week we are going to cover the following to help you set up a budget, and more importantly, stick to it!

- The business expense MYTH

- Tracking your expenses

- Setting expense GOALS (budgeting!)

- Finding a system that works for you

Now… onto…

The BIG MYTH

How many times have you or one of your fellow small biz owners said the following:

“It’s a tax deduction.”

“Oh – I’ll get this, it’s a tax write-off.”

“All of these expenses should make for a great tax refund.”

If you have uttered these words, listen (read) closely:

A business expense is a tax deduction. However, a tax deduction does NOT mean the government is giving you any money or that you will ever see this expense come back to you in any form of money.

HOW TAX DEDUCTIONS WORK

Now stick with me… I’m going to talk in numbers (don’t be scared).

Let’s say in one week you make $1000, and you spend $800 of it on supplies, phone bills, and rent. This is what happens:

$1000 sales

– $800 expenses

$200 income that you will pay ~$60* of tax –> $140 income (money in your pocket)

But, if you spent $500 instead of $800, it would break down as:

$1000 sales

– $500 expenses

$500 income that you will pay ~$150* of tax –> $350 income (money in your pocket)

By spending $500 in expenses instead of $800, you were able to make $210 more (after taxes). The ONLY benefit to having more expenses is that you pay less tax. The BIG downside to having more expenses is that you have less income (LESS money in YOUR pocket).

Now repeat this after me:

Tax Deduction means that I pay less tax. Tax Deduction = Business Expense. A business expense (or a tax deduction) results in less income.

You are a PRO!

Tomorrow, we’ll go over some AWESOME systems for tracking your expenses. (Hint: there are some really cool, fun, online sites that make this easy-peasy.)

* For purposes of this example, the tax rate is 30%. It would largely depend on the annual income and the individual’s tax bracket.

What the pros are saying…